Choosing the right Forex account type is one of the most overlooked decisions among new traders. Many beginners focus heavily on strategies and indicators, yet ignore the structure of the trading account itself — even though it directly affects costs, execution speed, and overall performance.

In this guide, you’ll learn what Forex account types are, how Standard, Raw, ECN, and other accounts differ, and which account type suits your trading style best. This article is designed as a practical Forex trading guide for beginners and intermediate traders, written in clear language with real-world examples.

What Is a Forex Trading Account?

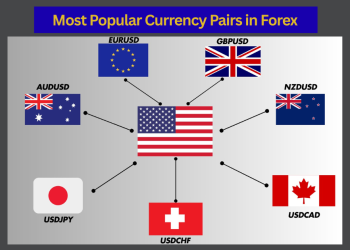

A Forex trading account is an account opened with a broker that allows you to buy and sell currency pairs in the foreign exchange market. While all accounts give access to the same market, the trading conditions can vary significantly depending on the account type.

These differences typically include:

-

Spread structure (fixed or variable)

-

Commission fees

-

Execution model

-

Minimum deposit

-

Available leverage

-

Suitable trading styles

Understanding these factors helps you control trading costs and avoid choosing an account that works against your strategy.

Why Forex Brokers Offer Different Account Types

Forex brokers serve a wide range of traders, from absolute beginners to institutional-level professionals. Offering multiple account types allows brokers to:

-

Match different risk tolerances

-

Cater to various trading frequencies

-

Provide cost flexibility

-

Segment beginner and professional users

For traders, this means there is no “best” account for everyone — only the best account for your trading goals.

1. Standard Forex Account

What Is a Standard Account?

A Standard Forex account is the most common account type and is often the default option for new traders. It typically features spread-only pricing, meaning trading costs are built into the spread with no separate commission.

Key Features

-

No commission

-

Wider spreads compared to Raw/ECN

-

Simple fee structure

-

Beginner-friendly

-

Often low minimum deposit

Example

If EUR/USD has a spread of 1.2 pips, that cost already includes the broker’s fee. You don’t pay anything extra per trade.

Pros

-

Easy to understand

-

No surprise fees

-

Good for learning and long-term trades

Cons

-

Higher trading costs for scalping

-

Less transparent pricing

Best For

-

Forex trading for beginners

-

Swing traders

-

Position traders

-

Low-frequency traders

START WITH STANDARD FOREX ACCOUNT NOW

2. Raw Spread Forex Account

What Is a Raw Account?

A Raw Spread account offers very tight spreads, often starting from 0.0 pips, but charges a fixed commission per trade. This model reflects near-market pricing and is popular among active traders.

Key Features

-

Ultra-low spreads

-

Fixed commission (per lot, per side)

-

Market-based pricing

-

Faster execution

Example

EUR/USD spread: 0.1 pip

Commission: $3 per side per lot

Total cost ≈ lower than Standard accounts for active traders

Pros

-

Lower total cost for high-volume trading

-

Transparent pricing

-

Ideal for scalping

Cons

-

Commission can confuse beginners

-

Requires better cost calculation skills

Best For

-

Scalpers

-

Day traders

-

Algorithmic traders

-

Experienced traders

START WITH RAW SPREAD FOREX ACCOUNT NOW !

3. ECN Forex Account

What Is an ECN Account?

An ECN (Electronic Communication Network) account connects traders directly to a network of liquidity providers such as banks and financial institutions. Orders are matched in real time without dealer intervention.

Key Features

-

Direct market access

-

Variable spreads

-

Commission-based

-

High execution transparency

Important Note

Not all brokers advertising “ECN” accounts provide true ECN access. Always verify execution details and liquidity sources.

Pros

-

Institutional-level execution

-

Minimal broker conflict of interest

-

Ideal for news trading

Cons

-

Higher minimum deposit

-

Commission-based pricing

-

Not beginner-friendly

Best For

-

Professional traders

-

High-volume traders

-

News traders

4. Cent (Micro) Forex Account

What Is a Cent Account?

A Cent account displays balances in cents instead of dollars. A $10 deposit appears as 1,000 cents, allowing traders to trade extremely small position sizes.

Key Features

-

Very low risk

-

Real-market environment

-

Ideal for practice

Pros

-

Minimal capital required

-

Psychological comfort

-

Great transition from demo to real trading

Cons

-

Limited account features

-

Not suitable for scaling profits

Best For

-

Absolute beginners

-

Strategy testing

-

Confidence building

START WITH CENT FOREX ACCOUNT NOW !

5. Demo Forex Account

What Is a Demo Account?

A demo account simulates real market conditions using virtual funds. It’s an essential tool for learning how to trade Forex without financial risk.

Pros

-

Risk-free learning

-

Strategy testing

-

Platform familiarity

Cons

-

No emotional pressure

-

Slippage and execution may differ slightly from live markets

Best For

-

Beginners

-

Testing new strategies

-

Platform practice

6. Islamic (Swap-Free) Forex Account

What Is an Islamic Account?

An Islamic Forex account complies with Sharia law by eliminating overnight swap fees. Instead, brokers may apply a fixed administrative fee.

Pros

-

No interest charges

-

Ethical compliance

-

Available for most account types

Cons

-

Possible replacement fees

-

Limited instruments

Best For

-

Muslim traders

-

Long-term holding strategies

How to Choose the Right Forex Account Type

When choosing a Forex account, consider these factors:

1. Trading Style

-

Scalping → Raw or ECN

-

Swing trading → Standard

-

Long-term investing → Standard or Islamic

2. Experience Level

-

Beginner → Demo, Cent, Standard

-

Intermediate → Standard or Raw

-

Advanced → Raw or ECN

3. Cost Sensitivity

High-frequency traders benefit from lower spreads + commission, while low-frequency traders may prefer spread-only pricing.

Common Mistakes When Choosing a Forex Account

-

Choosing ECN too early

-

Ignoring commission structure

-

Overestimating leverage needs

-

Not reading broker conditions carefully

Your account type should support your strategy, not complicate it.

Final Thoughts

Forex account types are more than just labels. They define how much you pay, how fast your trades execute, and how scalable your strategy is. Understanding the differences between Standard, Raw, ECN, and Cent accounts allows you to trade more efficiently and avoid unnecessary costs.

For beginners, simplicity matters. For professionals, precision matters. Choose accordingly — and revisit your account choice as your skills evolve.