Most beginner Forex traders do not fail because the market is unfair or unpredictable. They fail because they repeat the same avoidable mistakes—often within the first few months of trading.

Forex is one of the most accessible financial markets in the world, but that accessibility can create a false sense of simplicity. New traders often underestimate the importance of preparation, discipline, and risk control. As a result, small mistakes compound quickly and lead to unnecessary losses.

This article outlines the most common mistakes new Forex traders make, explains why they happen, and shows how to avoid them. Understanding these pitfalls early can dramatically improve long-term survival and consistency.

Mistake #1: Trading Without a Clear Plan

Mistake #1: Trading Without a Clear Plan

One of the earliest and most damaging mistakes is entering trades without a defined trading plan.

A trading plan should clearly state:

-

Entry criteria

-

Exit rules (stop-loss and take-profit)

-

Risk per trade

-

Trading timeframe

-

Market conditions to trade (or avoid)

Without a plan, trades are driven by emotion rather than logic. Even profitable trades become meaningless if they cannot be repeated consistently.

How to avoid it:

Write down your trading rules and follow them exactly. If you cannot explain why you entered a trade, you should not be in it.

Mistake #2: Overleveraging the Trading Account

Mistake #2: Overleveraging the Trading Account

Leverage allows traders to control large positions with a small amount of capital. While this can amplify profits, it also magnifies losses.

New traders often:

-

Use maximum leverage by default

-

Open positions too large for their account size

-

Underestimate how quickly drawdowns occur

Overleveraging is one of the fastest ways to wipe out an account—even with a high win rate.

How to avoid it:

Focus on position sizing, not profit potential. Risk a small, fixed percentage of your account per trade.

Mistake #3: Ignoring Risk Management

Mistake #3: Ignoring Risk Management

Many beginners concentrate on finding “high-probability setups” but neglect risk management entirely.

Common risk management mistakes include:

-

Trading without a stop-loss

-

Moving stop-losses emotionally

-

Risking inconsistent amounts per trade

Risk management is not optional. It determines how long you can stay in the market.

How to avoid it:

Decide your risk before entering a trade. A good trade with poor risk management is still a bad trade.

Mistake #4: Overtrading and Revenge Trading

Mistake #4: Overtrading and Revenge Trading

After a loss, many beginners feel the urge to “make it back” quickly. This often leads to:

-

Taking low-quality setups

-

Increasing position size impulsively

-

Trading outside planned sessions

Overtrading increases transaction costs and emotional fatigue, both of which degrade performance.

How to avoid it:

Set daily or weekly trade limits. Accept that losses are part of the process, not something that must be corrected immediately.

Mistake #5: Using Too Many Indicators

Mistake #5: Using Too Many Indicators

New traders often clutter their charts with multiple indicators, hoping more signals will lead to better decisions.

In reality:

-

Too many indicators create conflicting signals

-

Decision-making becomes slower and less confident

-

Analysis paralysis sets in

Most professional traders rely on a small number of tools, often combined with price action.

How to avoid it:

Master one or two indicators thoroughly instead of using many superficially.

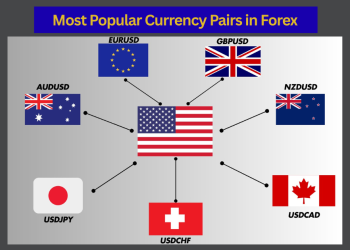

Mistake #6: Trading Every Market and Every Pair

Mistake #6: Trading Every Market and Every Pair

Beginners often jump between multiple currency pairs and markets, chasing movement rather than understanding behavior.

Each currency pair has:

-

Different volatility patterns

-

Different session activity

-

Different sensitivity to news

Constantly switching pairs prevents pattern recognition and consistency.

How to avoid it:

Focus on one or two major currency pairs and learn how they behave under different market conditions.

Mistake #7: Ignoring Trading Costs

Mistake #7: Ignoring Trading Costs

Transaction costs may seem small, but they add up quickly—especially for active traders.

Common overlooked costs include:

-

Spread widening during news

-

Commission on high-frequency trades

-

Swap fees on overnight positions

Many beginners realize too late that costs have significantly reduced their net performance.

How to avoid it:

Understand how spreads, commissions, and swaps affect your strategy before choosing an account type.

Mistake #8: Choosing the Wrong Account Type

Mistake #8: Choosing the Wrong Account Type

Not all trading accounts are suitable for all traders. New traders often select an account without understanding:

-

Spread structure

-

Commission model

-

Execution conditions

For example, frequent traders using wide-spread accounts may unknowingly pay excessive costs.

👉 Because of this, many beginners eventually look into account options designed for different trading behaviors, especially after realizing how pricing models impact performance.

Mistake #9: Trading During High-Impact News Without Preparation

Mistake #9: Trading During High-Impact News Without Preparation

Economic announcements can cause rapid price movements, slippage, and spread expansion.

New traders often:

-

Enter trades just before news

-

Leave positions unprotected

-

Underestimate volatility spikes

This can lead to losses unrelated to strategy quality.

How to avoid it:

Track major economic events and reduce exposure during high-impact releases unless you have a clear news-trading plan.

Mistake #10: Unrealistic Expectations

Mistake #10: Unrealistic Expectations

Perhaps the most common mistake is expecting fast, consistent profits.

Unrealistic expectations lead to:

-

Overtrading

-

Overleveraging

-

Emotional decision-making

Forex trading is a skill that develops over time, not a shortcut to quick income.

How to avoid it:

Focus on process improvement, not short-term profit. Consistency matters more than speed.

Why Most Beginner Mistakes Are Psychological

While many mistakes appear technical, they are usually psychological in nature:

-

Fear of missing out

-

Fear of loss

-

Overconfidence after wins

Technical knowledge alone is not enough. Self-awareness and discipline are equally important.

How to Learn From Mistakes Faster

To accelerate improvement:

-

Keep a trading journal

-

Review losing trades objectively

-

Track mistakes, not just profits

Progress in trading comes from reducing errors, not eliminating losses entirely.

Conclusion

Every successful Forex trader has made mistakes—but not all traders learn from them. The difference between failure and progress lies in awareness, discipline, and adaptation.

By understanding and avoiding these common mistakes of new Forex traders, beginners can significantly increase their chances of long-term survival and steady improvement.

Trading success is built by eliminating bad habits before trying to optimize good ones.