One of the most common mistakes traders make is applying the same trading strategy to every market environment.

A strategy that performs well in a trending market often fails completely in a ranging or choppy market.

Before asking “Which trading strategy should I use?”, the real question should be:

What market condition am I trading right now?

In this guide, you will learn how to identify market conditions in trading, why it matters, and how different conditions require different strategic approaches.

1. What Is a Market Condition in Trading?

A market condition describes the overall behavior and structure of price over a period of time.

Instead of focusing on indicators or entry techniques, market condition analysis answers three fundamental questions:

-

Is price moving in one direction or sideways?

-

How strong and consistent is that movement?

-

Is volatility expanding or contracting?

Every market, regardless of asset class, rotates through different conditions.

2. The Four Core Market Conditions

Most trading environments can be classified into four primary market conditions.

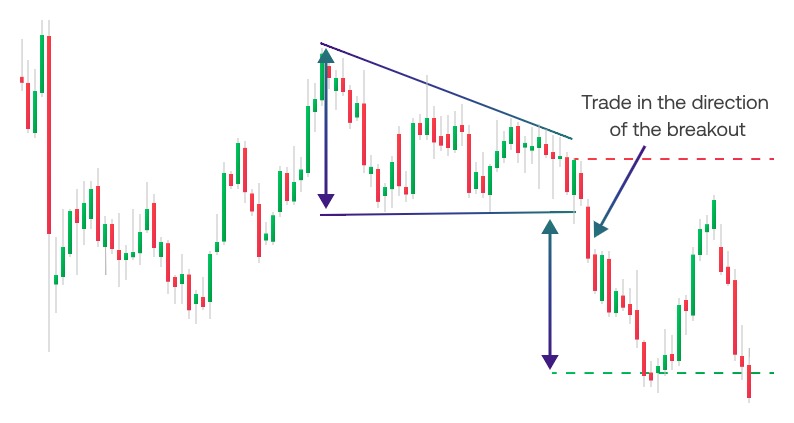

2.1 Trending Market

A trending market is characterized by consistent higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

Key characteristics:

-

Directional movement

-

Pullbacks are shallow and controlled

-

Momentum favors continuation

Typical trader mistake:

Trying to fade or counter-trade strong trends.

➡️ Best suited for: Trend-following and breakout-based strategies

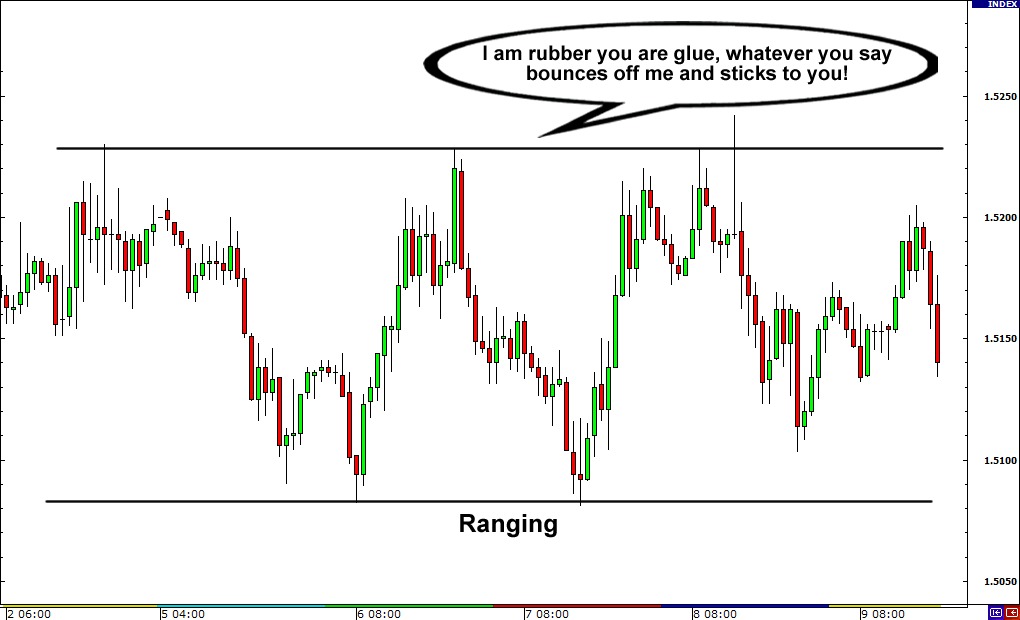

2.2 Ranging Market

A ranging market moves sideways within a defined price range.

Key characteristics:

-

Clear support and resistance

-

Price oscillates without clear direction

-

Breakouts often fail

Typical trader mistake:

Using trend-following strategies where no trend exists.

➡️ Best suited for: Mean reversion and range-based strategies

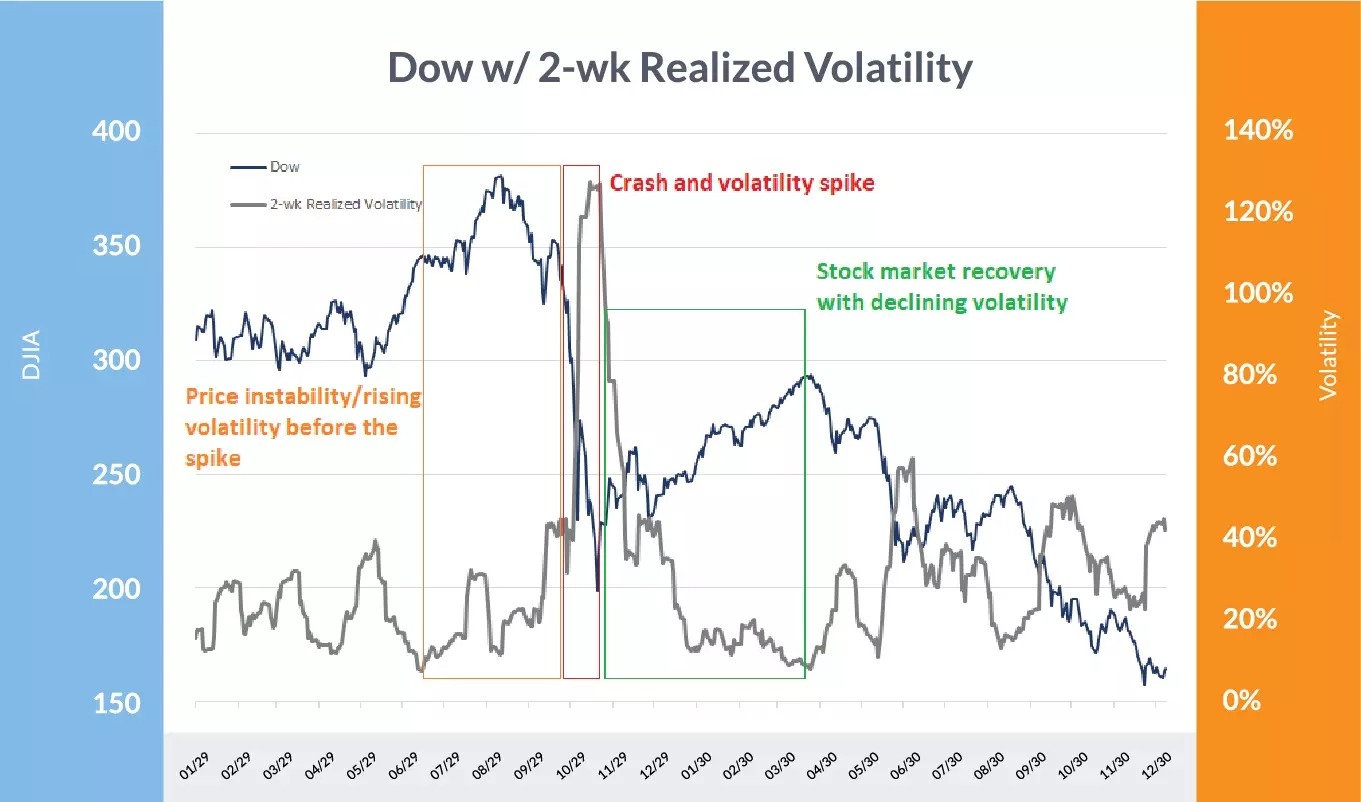

2.3 High Volatility Market

High volatility markets show large price swings, often driven by news, macro events, or strong participation.

Key characteristics:

-

Large candles

-

Wide trading ranges

-

Increased risk and opportunity

Typical trader mistake:

Using normal position size and tight stops.

➡️ Requires: Adjusted risk management and volatility-aware strategies

2.4 Choppy Market

A choppy market is one of the most dangerous environments for traders.

Key characteristics:

-

No clear trend

-

No clean range

-

Frequent false breakouts

-

Stop-loss hunting behavior

Typical trader mistake:

Overtrading and forcing setups.

➡️ Often best action: Do not trade

3. How to Identify Market Conditions (Step-by-Step)

Step 1: Observe Market Structure

Ignore indicators initially and focus on price behavior:

-

Higher highs / lower lows → trending

-

Equal highs / equal lows → ranging

-

Erratic swings → choppy

Step 2: Measure Volatility

You do not need advanced tools. Simple observations help:

-

Candle size relative to recent history

-

Speed of price movement

-

Distance between swings

Step 3: Check Timeframe Alignment

A market can be:

-

Trending on H4

-

Ranging on M15

-

Choppy on M5

Market condition is timeframe-dependent, not universal.

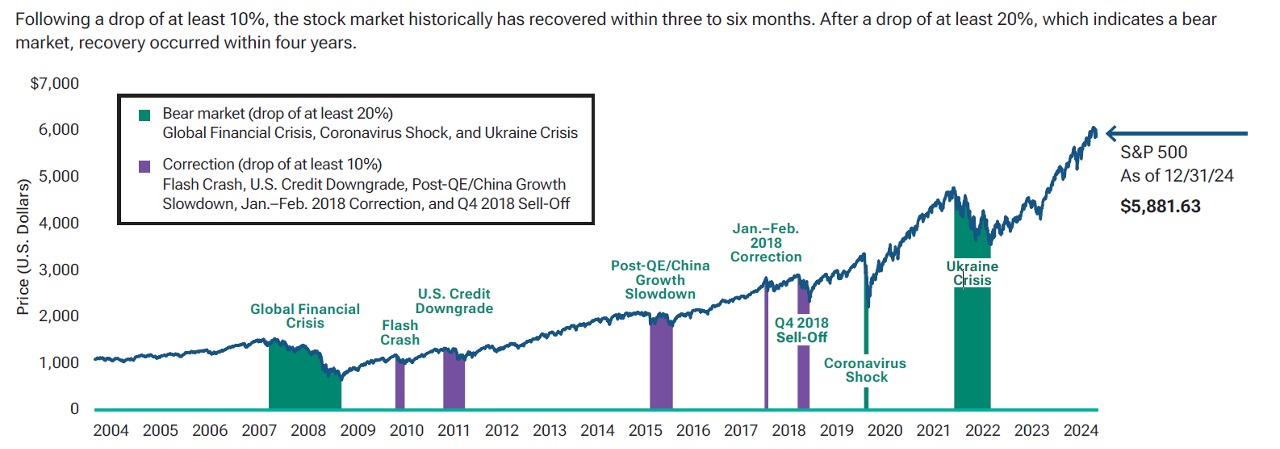

4. Why Market Condition Matters More Than Strategy Choice

Many traders jump from one strategy to another, assuming the strategy is the problem.

In reality:

-

The strategy may be correct

-

The market condition is wrong

A solid trading strategy only works when applied in the environment it was designed for.

This is why professional traders focus first on context, not entries.

5. Market Conditions Change – Strategies Must Adapt

Markets are dynamic, not static.

A trending market can transition into:

-

Consolidation

-

Distribution

-

High volatility news phase

Successful traders reassess conditions continuously instead of forcing consistency.

6. Market Condition vs Indicator Signals

Indicators often give signals without context.

A buy signal in:

-

A trending market → opportunity

-

A choppy market → trap

Market condition acts as a filter, deciding whether a signal deserves attention.

7. Final Thoughts

Identifying market conditions is not about prediction.

It is about alignment.

When your strategy matches the market environment, execution becomes easier, risk decreases, and consistency improves.

Before your next trade, ask one question:

What market condition am I trading right now?