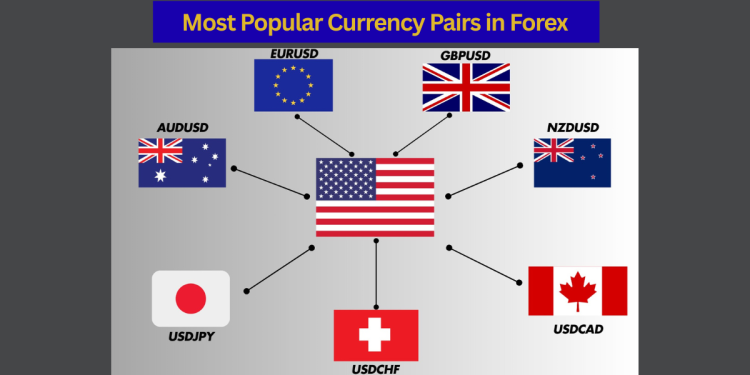

In the Forex market, traders do not buy or sell individual currencies in isolation. Instead, every transaction involves a currency pair, where one currency is exchanged for another. Understanding how different currency pairs behave is one of the most important foundations in Forex trading, yet it is often underestimated by beginners.

Each currency pair has its own liquidity profile, volatility pattern, trading costs, and sensitivity to economic events. Some pairs move smoothly and predictably, while others are fast, aggressive, and highly reactive to news. Choosing the wrong pair for your experience level or trading style can significantly increase risk, even if your strategy is technically sound.

This article provides a comprehensive breakdown of the most popular currency pairs in Forex, explains how they are classified, and analyzes the key properties of each major pair. By the end, you will understand not only which pairs are most traded, but why they behave the way they do.

What Is a Currency Pair in Forex?

A currency pair represents the exchange rate between two currencies:

-

The base currency (first currency)

-

The quote currency (second currency)

For example, in EUR/USD, the euro is the base currency and the US dollar is the quote currency. If EUR/USD is trading at 1.1000, it means one euro is worth 1.10 US dollars.

Currency pair prices are not random. They reflect:

-

Relative economic strength

-

Interest rate differences

-

Capital flows between countries

-

Market sentiment and risk appetite

In essence, when you trade a currency pair, you are expressing a view on which economy is likely to perform better relative to the other.

How Currency Pairs Are Classified

Forex currency pairs are commonly divided into three main categories based on liquidity, trading volume, and market participation.

1. Major Currency Pairs

Major pairs:

-

Always include the US dollar (USD)

-

Have the highest trading volume globally

-

Offer the tightest spreads and best execution

These pairs dominate institutional and retail trading activity and are generally considered the most beginner-friendly.

2. Minor (Cross) Currency Pairs

Minor pairs:

-

Do not include USD

-

Are formed by combining major non-USD currencies

-

Have moderate liquidity and slightly higher spreads

They are often used by traders who want exposure to specific regional economies without USD influence.

3. Exotic Currency Pairs

Exotic pairs:

-

Combine a major currency with a currency from an emerging or smaller economy

-

Have low liquidity and wide spreads

-

Are more vulnerable to political and economic instability

These pairs are typically unsuitable for new traders.

Major Currency Pairs and Their Key Properties

EUR/USD – The Benchmark of the Forex Market

EUR/USD is the most actively traded currency pair in the world and is often considered the benchmark for Forex liquidity.

Key properties:

-

Extremely high liquidity

-

Very tight spreads across all trading sessions

-

Smooth price action compared to other pairs

Market drivers:

-

Interest rate policies of the Federal Reserve and the European Central Bank

-

Inflation, GDP, and employment data from the US and Eurozone

-

Broader global risk sentiment

Trading characteristics:

EUR/USD tends to respect technical levels well, making it suitable for technical analysis, range trading, and trend-following strategies.

GBP/USD – Volatility and Momentum

GBP/USD, commonly known as “Cable,” is known for sharper price movements compared to EUR/USD.

Key properties:

-

Higher volatility

-

Strong directional moves during the London session

-

Slightly wider spreads than EUR/USD

Market drivers:

-

Bank of England interest rate decisions

-

UK inflation and labor market data

-

Political developments affecting the British economy

Trading characteristics:

This pair often produces strong intraday trends but can experience sudden reversals, requiring disciplined risk management.

USD/JPY – Risk Sentiment Indicator

USD/JPY reflects the relationship between the US dollar and the Japanese yen, a traditional safe-haven currency.

Key properties:

-

High liquidity

-

Typically lower volatility during calm markets

-

Sharp movements during risk-off periods

Market drivers:

-

US bond yields

-

Bank of Japan monetary policy

-

Global equity market sentiment

Trading characteristics:

USD/JPY is highly sensitive to changes in risk appetite, making it popular among traders who monitor macroeconomic and sentiment indicators.

USD/CHF – Stability and Safe-Haven Demand

The Swiss franc is another safe-haven currency, and USD/CHF often moves in response to global uncertainty.

Key properties:

-

Moderate volatility

-

Strong correlation with risk sentiment

-

Reliable liquidity during European and US sessions

Market drivers:

-

Swiss National Bank interventions

-

Capital flows during geopolitical stress

-

Movements in the US dollar index

AUD/USD – Commodity and Growth Exposure

AUD/USD is closely linked to the Australian economy and global demand for commodities.

Key properties:

-

Medium volatility

-

Active during the Asian trading session

-

Sensitive to economic data from China

Market drivers:

-

Commodity prices (iron ore, coal)

-

Reserve Bank of Australia policy

-

Chinese economic indicators

Trading characteristics:

AUD/USD often performs well in risk-on environments and weakens during global slowdowns.

NZD/USD – Smaller Market, Similar Behavior

NZD/USD shares similarities with AUD/USD but generally shows lower liquidity.

Key properties:

-

Slightly wider spreads than AUD/USD

-

Clear reactions to agricultural export data

-

Influenced by regional economic trends

USD/CAD – The Oil-Linked Pair

USD/CAD is heavily influenced by crude oil prices due to Canada’s role as a major energy exporter.

Key properties:

-

Medium volatility

-

Strong correlation with oil markets

-

Active during the New York session

Market drivers:

-

Crude oil price movements

-

Bank of Canada policy decisions

-

US economic data

Minor Currency Pairs (Cross Pairs)

EUR/GBP – Regional Economic Comparison

EUR/GBP reflects economic performance differences between the Eurozone and the UK.

Key properties:

-

Lower volatility than GBP/USD

-

More range-bound behavior

-

Less influenced by global USD movements

EUR/JPY and GBP/JPY – High-Volatility Crosses

These pairs combine European currencies with the Japanese yen.

Key properties:

-

High volatility

-

Strong trend potential

-

Sensitive to global risk sentiment

They are generally better suited for experienced traders.

Exotic Currency Pairs and Their Risks

Examples include USD/TRY, EUR/ZAR, and USD/MXN.

Common characteristics:

-

Wide spreads

-

Low liquidity

-

High exposure to political and economic shocks

Exotic pairs can move aggressively but often involve hidden costs and execution risks.

Comparing Currency Pair Properties

| Category | Liquidity | Spread | Volatility | Suitable for Beginners |

|---|---|---|---|---|

| Major | Very High | Low | Moderate | Yes |

| Minor | Medium | Medium | Medium–High | With experience |

| Exotic | Low | High | High | No |

How to Choose the Right Currency Pair

When selecting a currency pair, traders should consider:

-

Experience level

-

Preferred trading session

-

Risk tolerance

-

Strategy type (scalping, day trading, swing trading)

Beginners typically benefit from focusing on one or two major pairs rather than switching frequently between markets.

Conclusion

Currency pairs are not interchangeable. Each pair has a distinct personality shaped by economic fundamentals, liquidity, and trader participation. By understanding the most popular Forex currency pairs and their properties, traders can make more informed decisions, reduce unnecessary risk, and align their strategies with market conditions.

Mastering currency pair selection is a critical step before advancing to more complex trading techniques.