In Forex trading, profitability is often misunderstood as the ability to predict market direction accurately. In reality, long-term success depends far more on risk management than on entry precision.

Many traders with strong technical knowledge still fail because they underestimate risk exposure, overtrade, or mismanage position size. Conversely, traders with average strategies but strict risk control often survive and grow steadily.

This article explains what risk management in Forex truly means, why it matters more than strategy selection, and how beginners can implement practical risk controls from day one.

What Is Risk Management in Forex?

Risk management refers to the systematic process of limiting potential losses while allowing profitable trades to develop naturally.

In Forex, risk management answers three fundamental questions:

-

How much capital should be risked per trade?

-

Where should losses be cut?

-

How does risk scale as account size changes?

Without clear answers to these questions, trading becomes speculation rather than a controlled activity.

Why Risk Management Matters More Than Strategy

Many beginner traders spend most of their time searching for:

-

The “best” indicator

-

The “most accurate” strategy

-

The “perfect” entry signal

However, no strategy wins 100% of the time. Even a system with a high win rate can fail if losses are not controlled.

Risk management determines:

-

Maximum drawdown tolerance

-

Psychological stability during losing streaks

-

Account survival during unfavorable market conditions

Simply put, risk management keeps traders in the game.

Core Principles of Forex Risk Management

1. Risk Per Trade

One of the most widely accepted rules is risking a small, fixed percentage of the account per trade.

Common ranges:

-

Conservative traders: 0.5%–1%

-

Moderate traders: 1%–2%

-

Aggressive traders: above 2% (not recommended for beginners)

By limiting risk per trade, a series of losses does not threaten account survival.

2. Position Sizing

Position size determines how much a trader gains or loses for each pip movement.

Incorrect position sizing often occurs when traders:

-

Trade fixed lot sizes regardless of stop-loss distance

-

Increase size after wins impulsively

-

Ignore account balance changes

Proper position sizing aligns stop-loss distance with risk tolerance.

Many traders rely on a position size calculator to quickly adjust lot size based on account balance, risk percentage, and stop-loss distance.

3. Stop-Loss Discipline

A stop-loss defines the point where a trade thesis is invalidated.

Common stop-loss mistakes include:

-

Trading without a stop-loss

-

Moving stops further away to avoid losses

-

Placing stops arbitrarily without structure

A stop-loss is not a sign of failure—it is a predefined cost of doing business.

4. Risk-to-Reward Ratio

Risk-to-reward ratio (R:R) measures how much potential reward is expected relative to the risk taken.

Examples:

-

Risk 1 to make 1 (1:1)

-

Risk 1 to make 2 (1:2)

-

Risk 1 to make 3 (1:3)

Even with a win rate below 50%, a favorable R:R can keep a strategy profitable.

Risk management focuses on outcomes over many trades, not individual results.

Account-Level Risk Management

Maximum Drawdown Limits

Drawdown refers to the decline from a peak account balance.

Professional traders often set:

-

Daily drawdown limits

-

Weekly loss caps

-

Maximum overall drawdown thresholds

Once reached, trading stops temporarily to prevent emotional decisions.

Correlation Risk

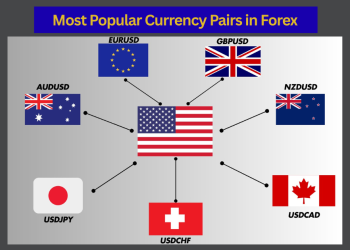

Trading multiple correlated currency pairs simultaneously increases hidden exposure.

For example:

-

EUR/USD and GBP/USD often move in similar directions

-

AUD/USD and NZD/USD share risk sentiment behavior

Risk management requires evaluating portfolio exposure, not just individual trades.

Psychological Risk Management

Risk is not only financial—it is psychological.

Poor risk control leads to:

-

Fear-driven exits

-

Revenge trading

-

Hesitation on valid setups

By defining risk clearly before entry, emotional pressure during trades decreases significantly.

Traders who know their maximum loss are more likely to:

-

Follow rules

-

Let trades play out

-

Accept losses calmly

Risk Management vs Money Management

Although often used interchangeably, they differ slightly:

-

Risk management focuses on limiting losses

-

Money management focuses on capital growth and allocation

Both are interconnected, but risk management always comes first.

Common Risk Management Mistakes

New traders frequently:

-

Increase risk after losses

-

Trade without calculating position size

-

Ignore spread and swap costs

-

Risk more during emotional states

Most of these errors stem from impatience rather than lack of knowledge.

Building a Simple Risk Management Framework

A basic framework for beginners:

-

Risk no more than 1% per trade

-

Always use a stop-loss

-

Maintain minimum 1:2 risk-to-reward

-

Limit total open risk across trades

-

Track performance over at least 50 trades

Simplicity increases consistency.

Why Risk Management Improves Long-Term Results

Risk management does not eliminate losses—but it controls their impact.

Over time, it:

-

Reduces emotional volatility

-

Smooths equity curves

-

Allows strategies to express edge

Successful traders do not avoid losing trades; they avoid large, unnecessary losses.

Conclusion

Risk management is the backbone of Forex trading. Without it, even the most sophisticated strategies fail under pressure.

By controlling position size, defining risk clearly, and maintaining discipline, traders shift from reactive behavior to structured decision-making.

In Forex, the goal is not to win every trade—it is to manage losses well enough that winners can compound over time.